Line Chart

This is the most basic chart. Take the following chart of SUNW. A simple look reveals that stock has been in an uptrend and has minor corrections from time to time.

Line charts are plotted using the "closing" price of the stock.

Bar Chart

Bar charts provide more information than line charts as one can see the open, high and low for the day (apart from the close).

The red bar means stock closed lower relative to the previous close. The blue bar means stock closed higher relative to the previous close. The "tick" on the left side is the open and the tick on the right side is the close.

Candle Stick

Candle stick (a 300 year old Japanese technique) give the same information as a bar but are visually more easy to read.

Red candles means stock closed lower relative to the previous close. Blue candles means stock closed higher relative to the previous close.

An Up Trend

For example, an uptrend is indicated by higher highs and higher lows. By

connecting the lows together, we get an upward sloping trend line. When

the trend line is sloping upwards, we have an uptrend.

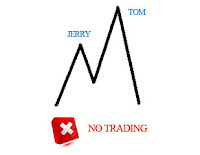

A Down Trend

A downtrend is indicated by lower highs and lower lows. By connecting

these points together, we can draw a downward sloping trend line. And

when the trend line is sloping downwards, we have a downtrend.

The purpose of Trend line

To state the obvious, the purpose of trend lines is to identify a

trend. As price moves in a trend, highs and lows are formed on the

chart.

By connecting these highs and lows with a line, we are able to identify what the current trend is.

- In an uptrend, draw a line through the lowest points in the trend without letting the line cross through prices.

- In a downtrend, draw a line through the highest points in the trend without letting the line cross through prices.

In both cases, you will need a minimum of at least two touches of the trend line.